Our challenge

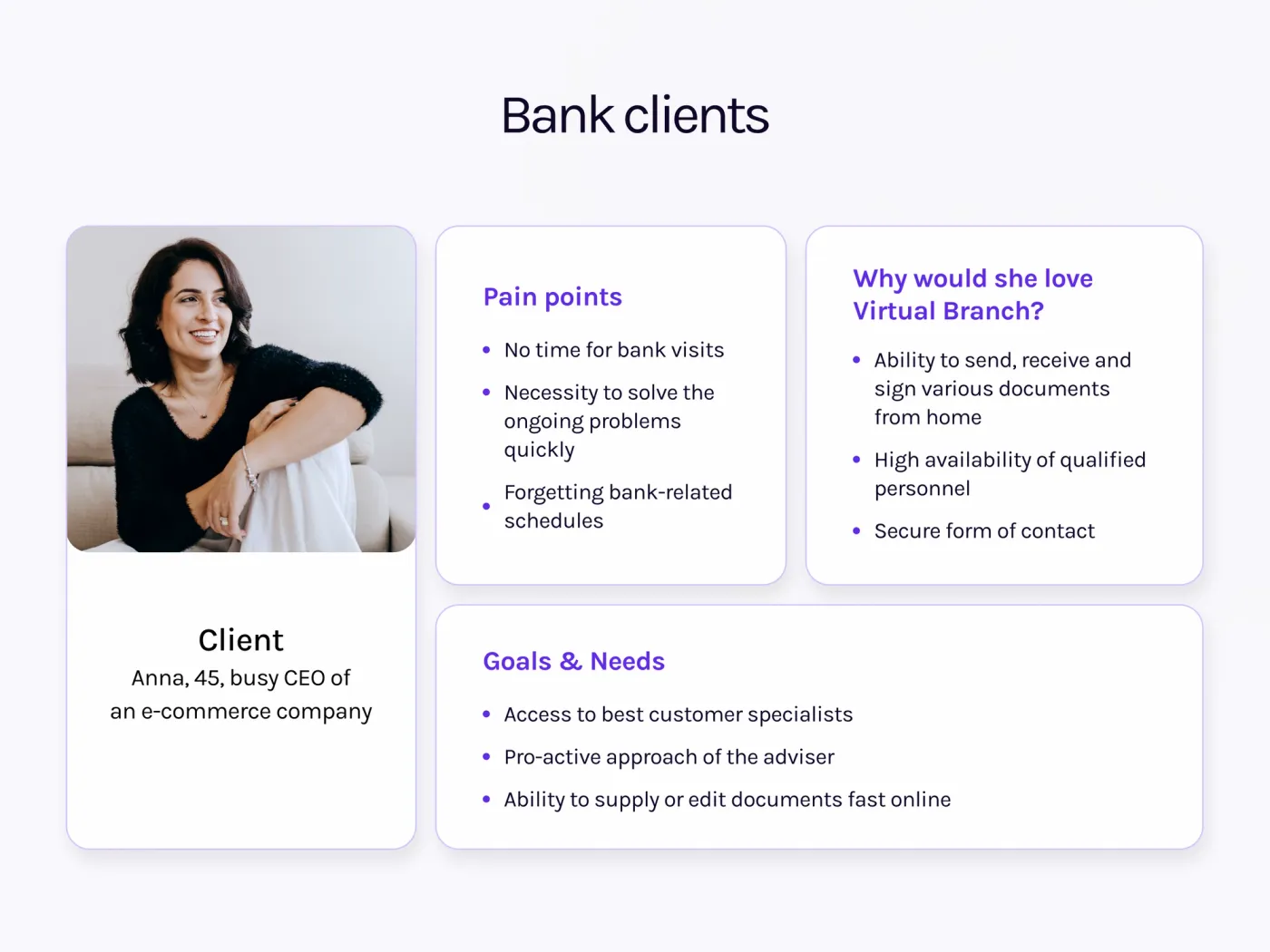

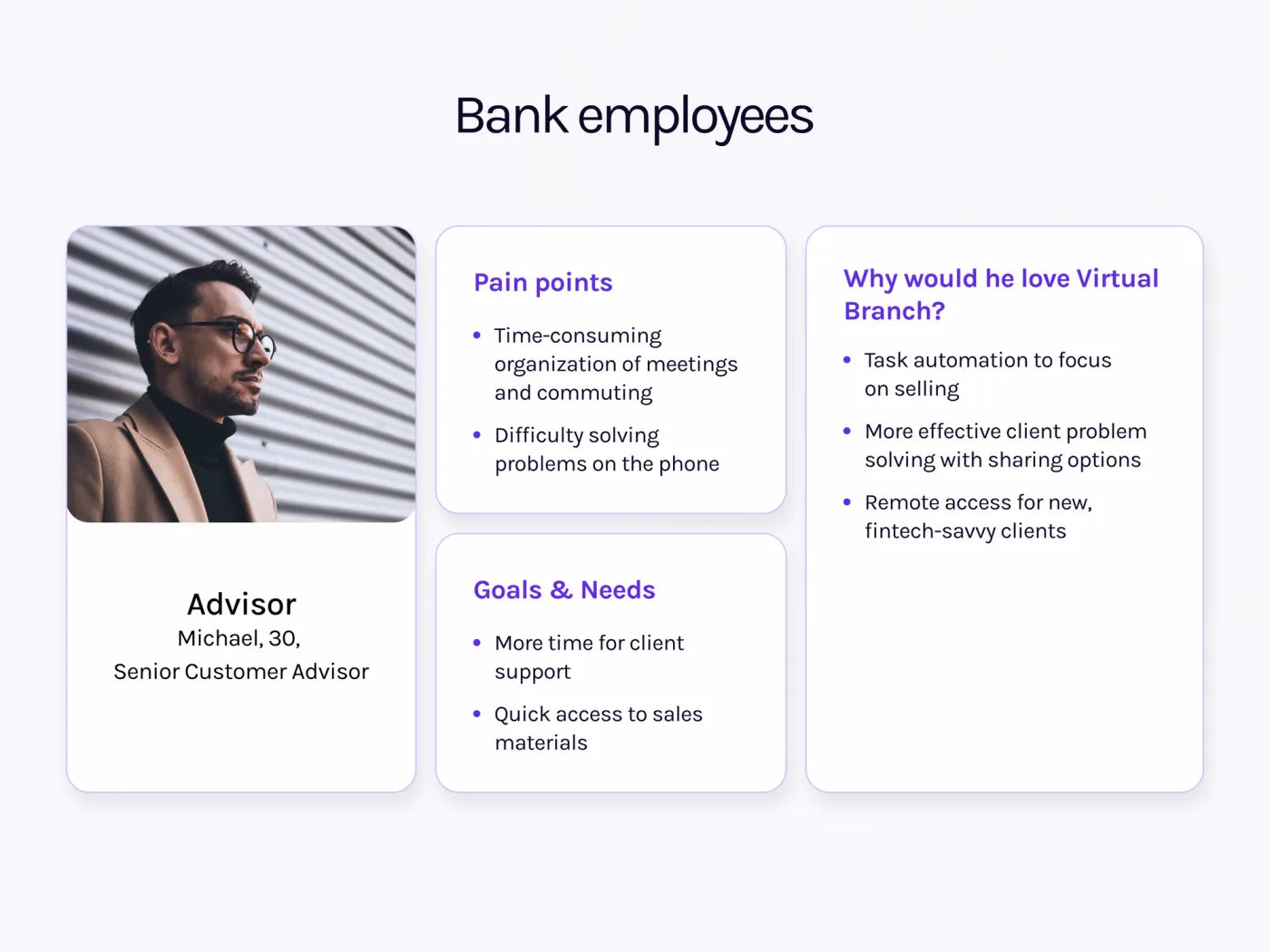

The lack of availability of remote banking services has a strong impact on client experience. Poor accessibility, little time flexibility, location restrictions or extreme situations such as account suspension while abroad, have come into the spotlight.

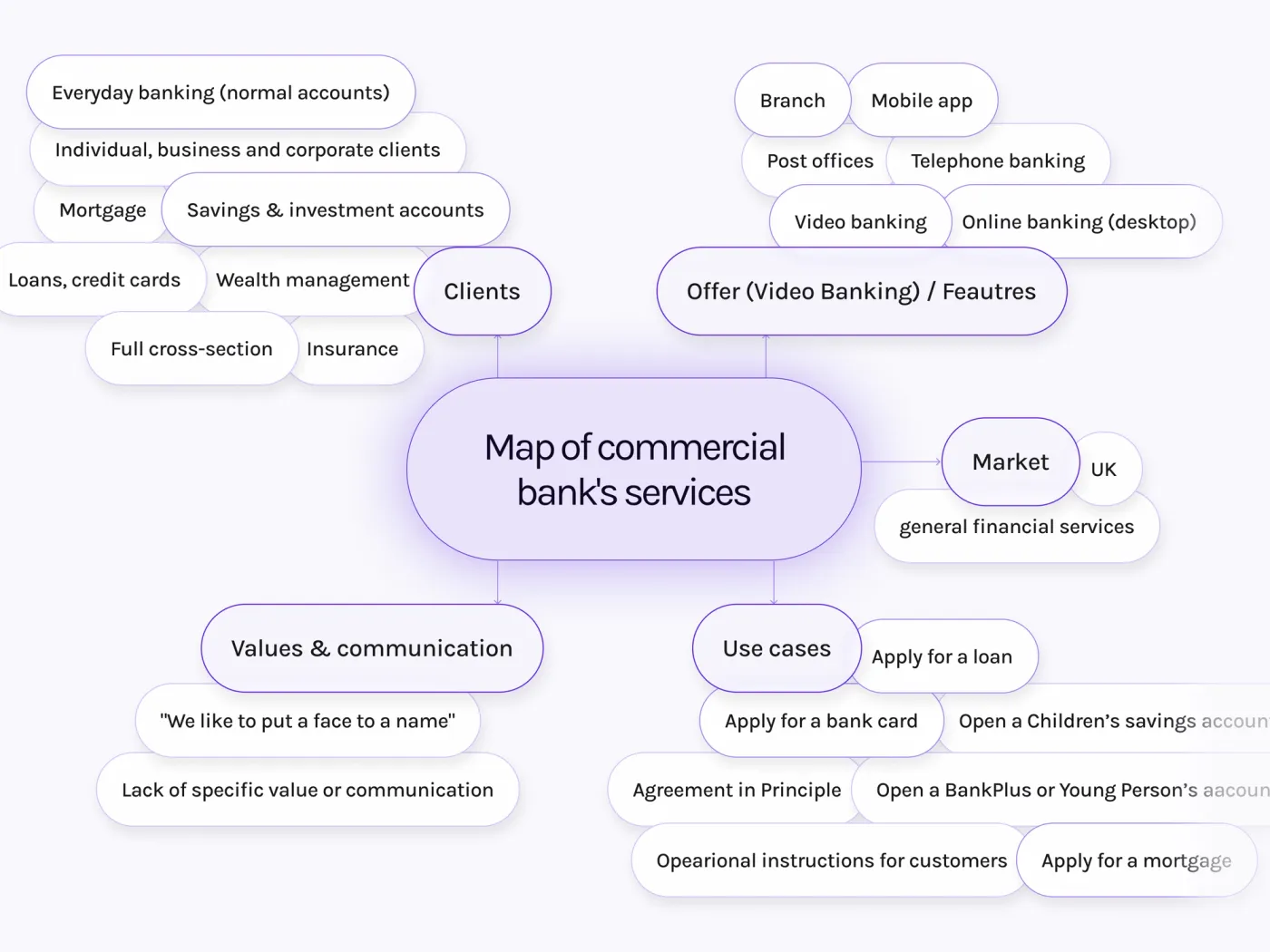

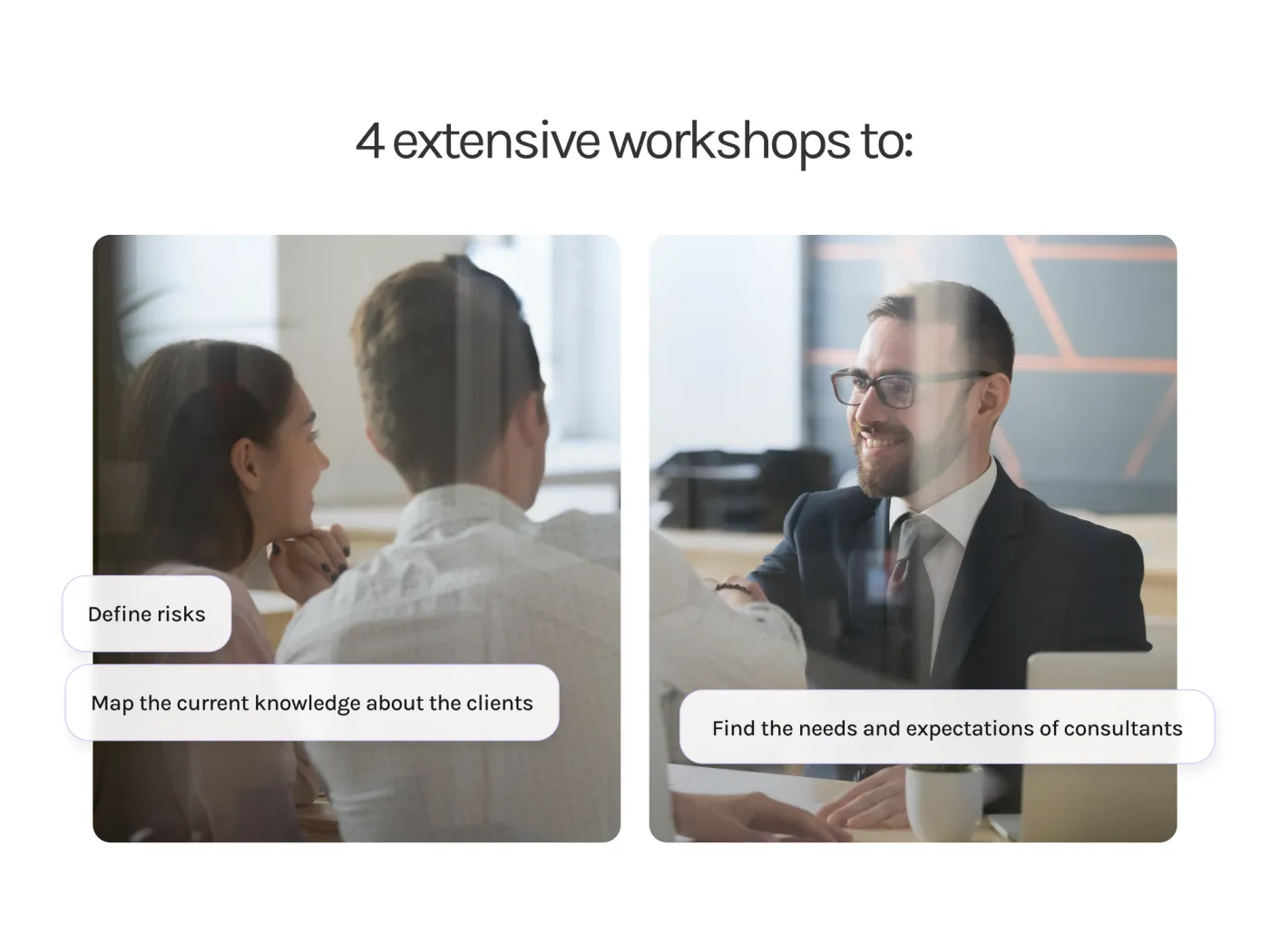

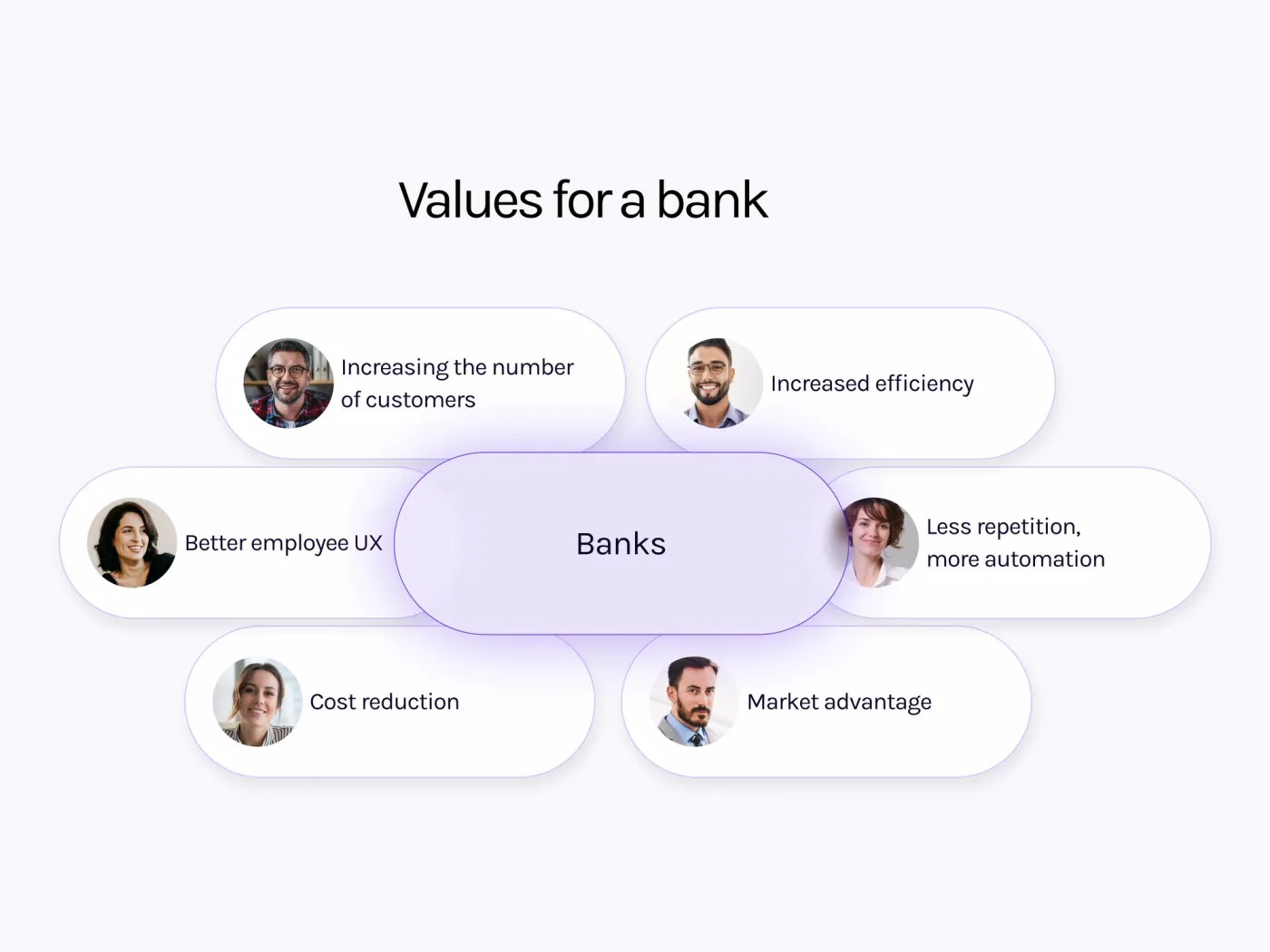

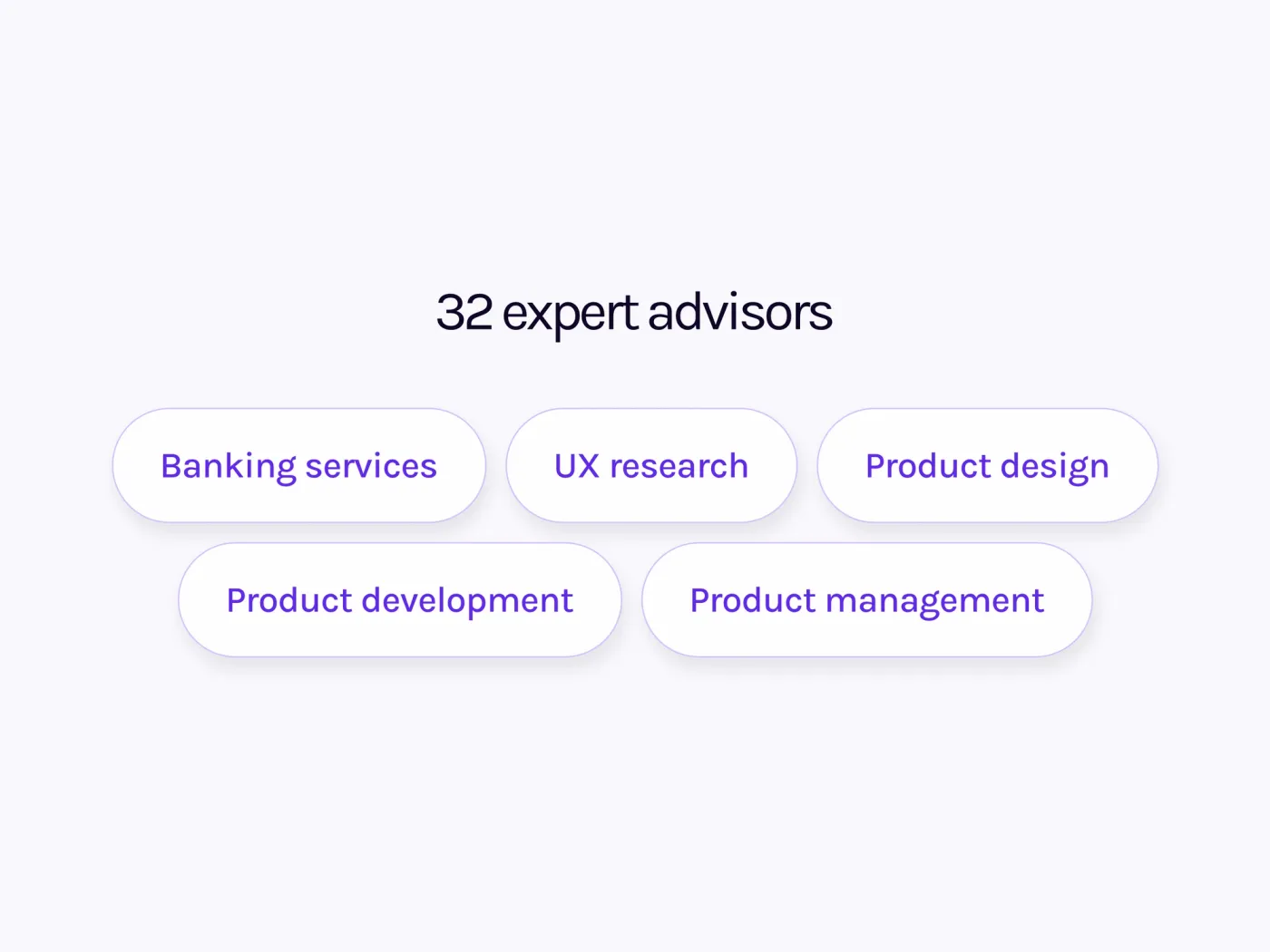

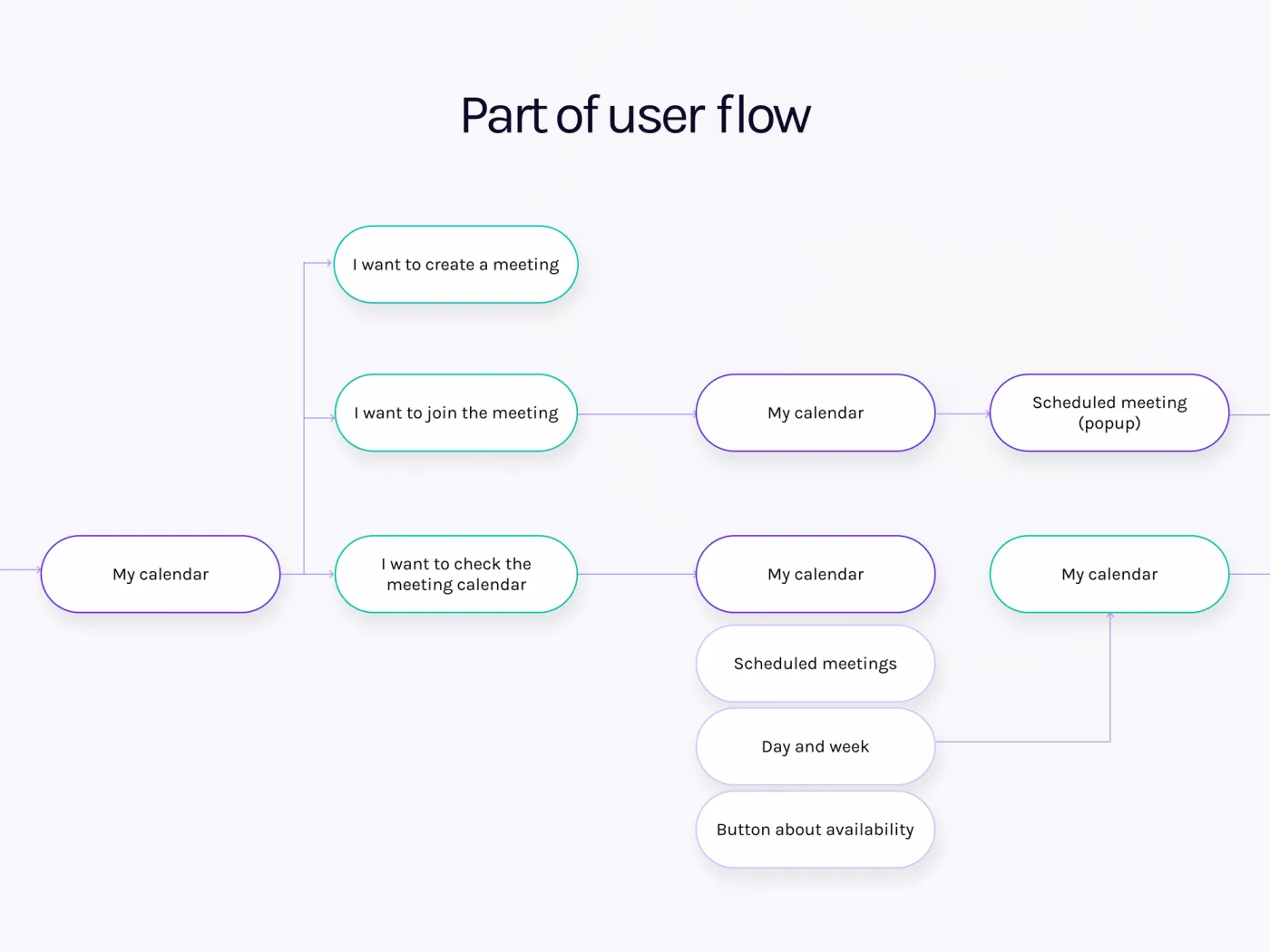

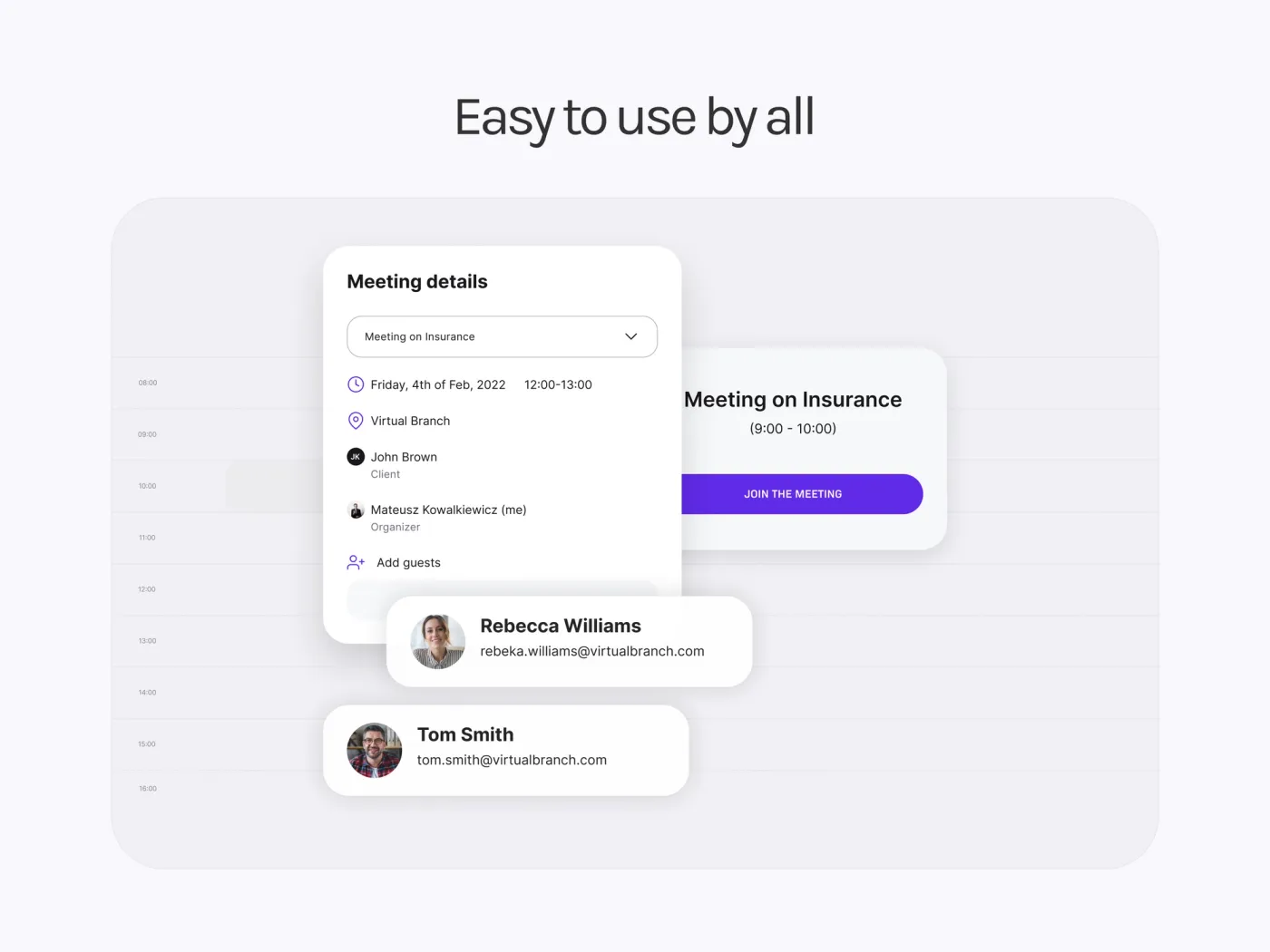

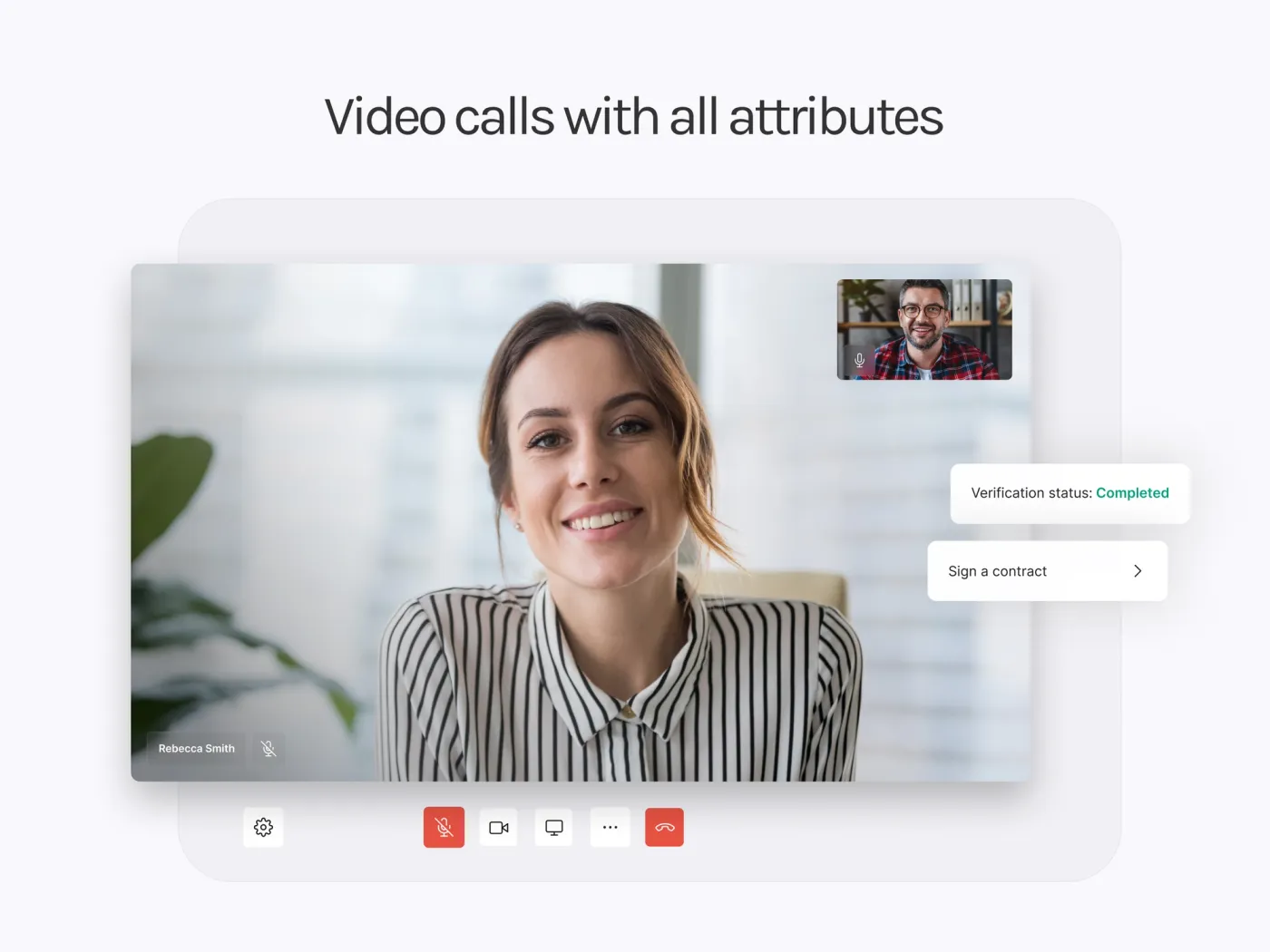

Observing the problems of limited access to remote banking services, 10Clouds in cooperation with Mastercard decided together to discover and validate a solution that would enable customers and employees a new quality of service.