- Moon Mortgage bypassed the traditional credit system, enabling those without a traditional credit score to secure property financing with cryptocurrency.

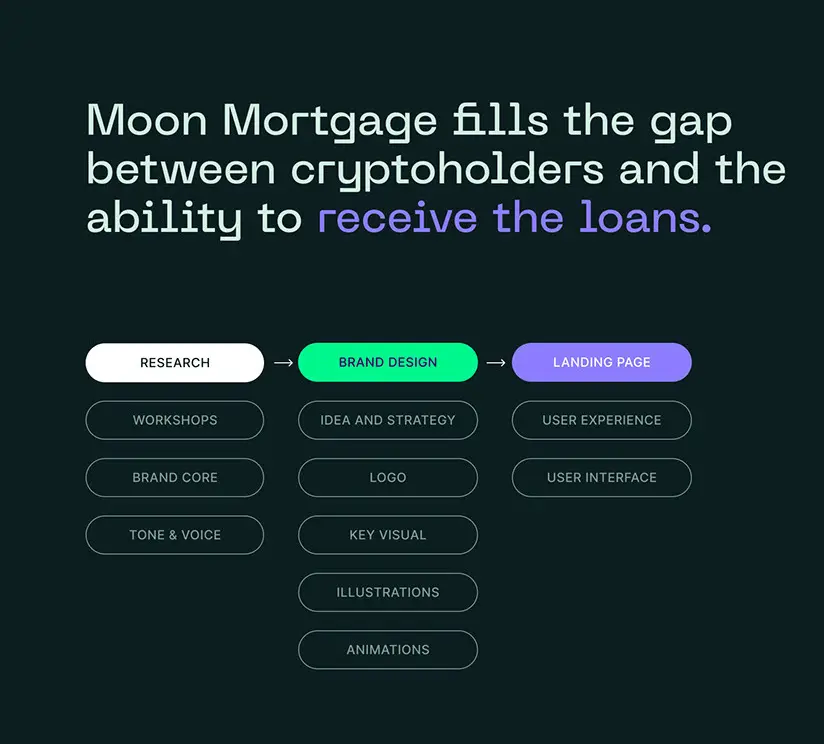

- Our goal was to design and develop a visually attractive platform that would make it possible, as well as deciding on and applying blockchain technology.

Building a Crypto-Based Mortgage Credit Platform

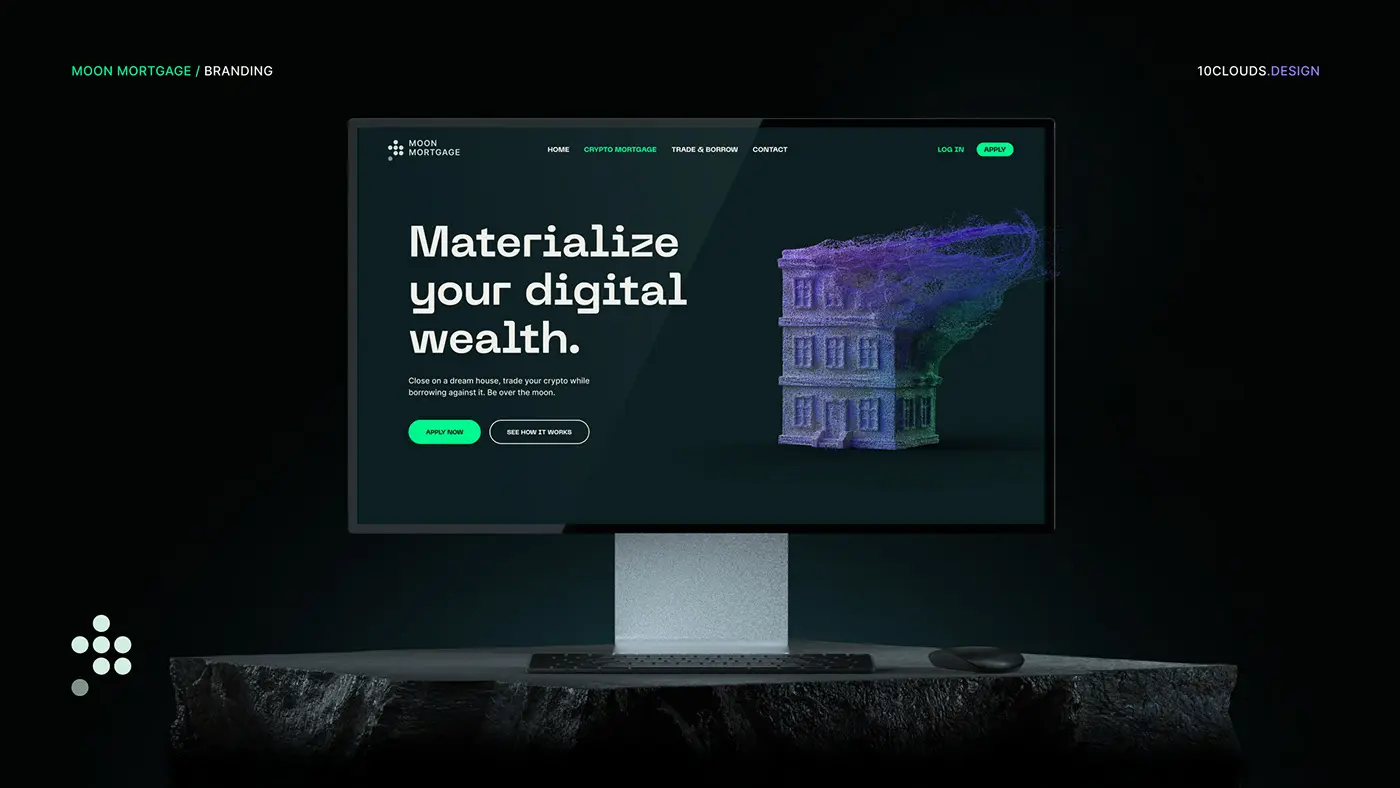

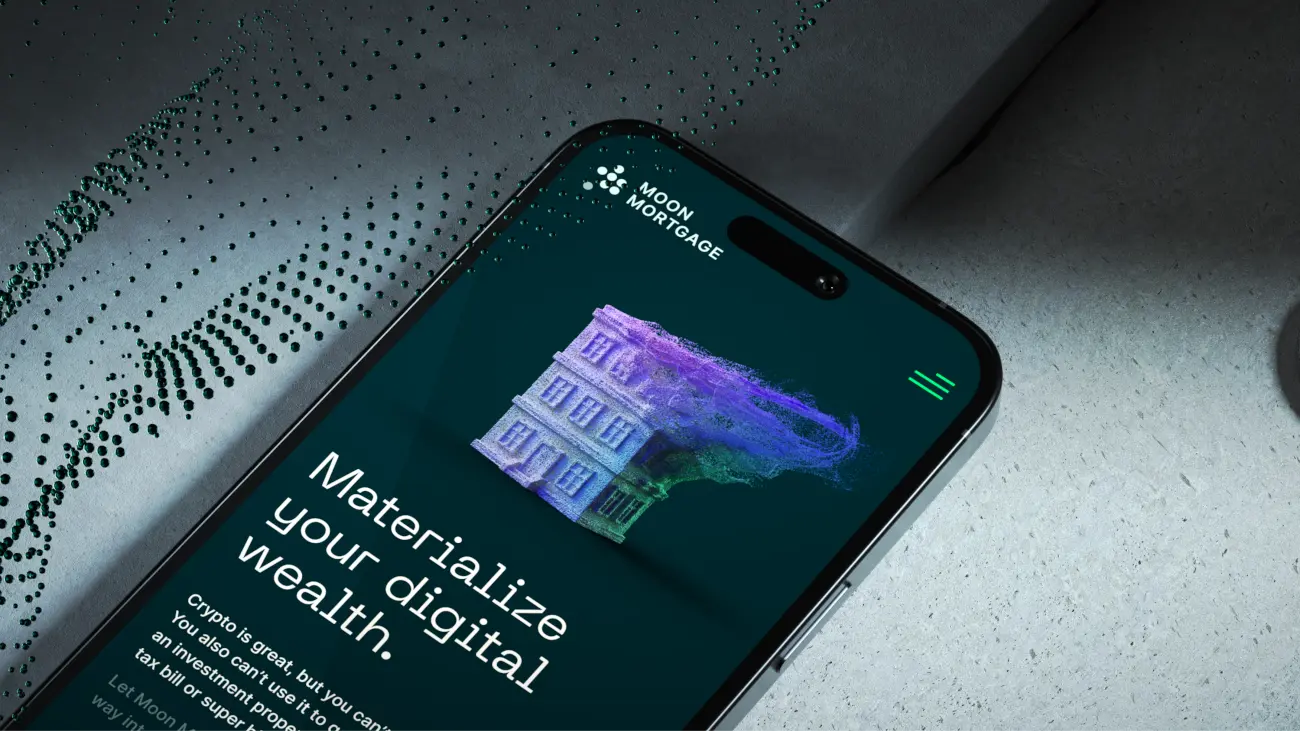

Website

Timeline

July 2022 - January 2023

Type

Credit Platform, Brandbook, Website

Country

United States

Industry

web3

From a startup to acquisition, Moon Mortgage is an example of a novelty in the web3 industry. 10Clouds helped discover the idea of this cryptocurrency-backed mortgage credit platform, and develop it into a compelling product with branding like no other.

Services

Technologies

Problem

The traditional mortgage world puts barriers for a growing population: crypto holders and people without traditional credit scores. Banks often dismiss cryptocurrency as a legitimate asset, locking out individuals whose wealth is primarily digital.

Besides, the current system penalizes crypto owners, triggering taxable events when they sell to buy property - diminishing their capital and future gains. International buyers face a near-impossible hurdle, as no US credit score means no loan, regardless of their financial strength. Moon Mortgage was born to dismantle these roadblocks.

Challenges

We were pioneering a new financial landscape. Building tools for the next generation meant navigating uncharted territory. There were no established precedents for using cryptocurrency as collateral for mortgages, requiring us to develop innovative solutions to address the unique challenges of this emerging market.

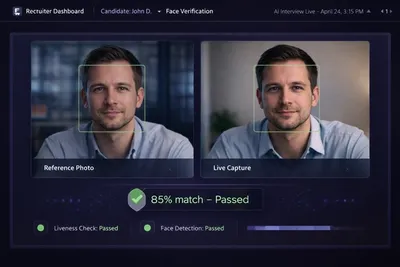

Trust was paramount from the outset

Users needed absolute confidence in the platform's security and reliability, knowing their valuable crypto assets were protected throughout the loan process.

Simplicity was another key hurdle

We aimed to create a user-friendly experience that demystified the often-intimidating processes of both crypto and mortgages, making the platform accessible to a broad audience, regardless of their financial or technical expertise.

Keeping a delicate balance

Maintaining the sophisticated, hi-tech functionality expected from a cutting-edge DeFi platform while simultaneously projecting the professional image necessary to instill trust and confidence in a major financial transaction was key.

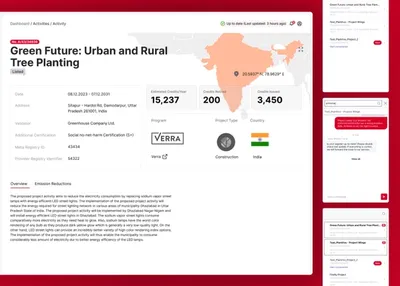

Connecting the asset location and the accounting system was crucial

Anchorage was chosen to be Moon Mortgage’s asset location, while Modern Treasury would serve as the platform’s accounting system. The core problem we faced was the difficulty in tracking real-time balances and managing transactions efficiently, as those two systems were separate.

The proposed solution revolved around a system of "pending transactions" implemented in the Modern Treasury accounting system. The goal was to prevent overspending and ensure accurate balance updates, especially during simultaneous trade requests.

Here's how it worked:

- Pending transaction

When a user initiates a trade, a "pending transaction" is posted to Modern Treasury with a flag indicating the minimum balance required. This acts as a reservation.

- Quote acceptance and confirmation

The user accepts the quote via Anchorage, which then confirms the transaction.

- Pending transaction update

Upon confirmation from Anchorage, the "pending transaction" in Modern Treasury is updated to reflect the actual trade.The process we established ensured concurrency control. If multiple trades are attempted simultaneously that would bring the user's balance below zero, the initial "pending transaction" request will fail, preventing the subsequent trades from being processed.

Deliverables

Deliverables

Platform

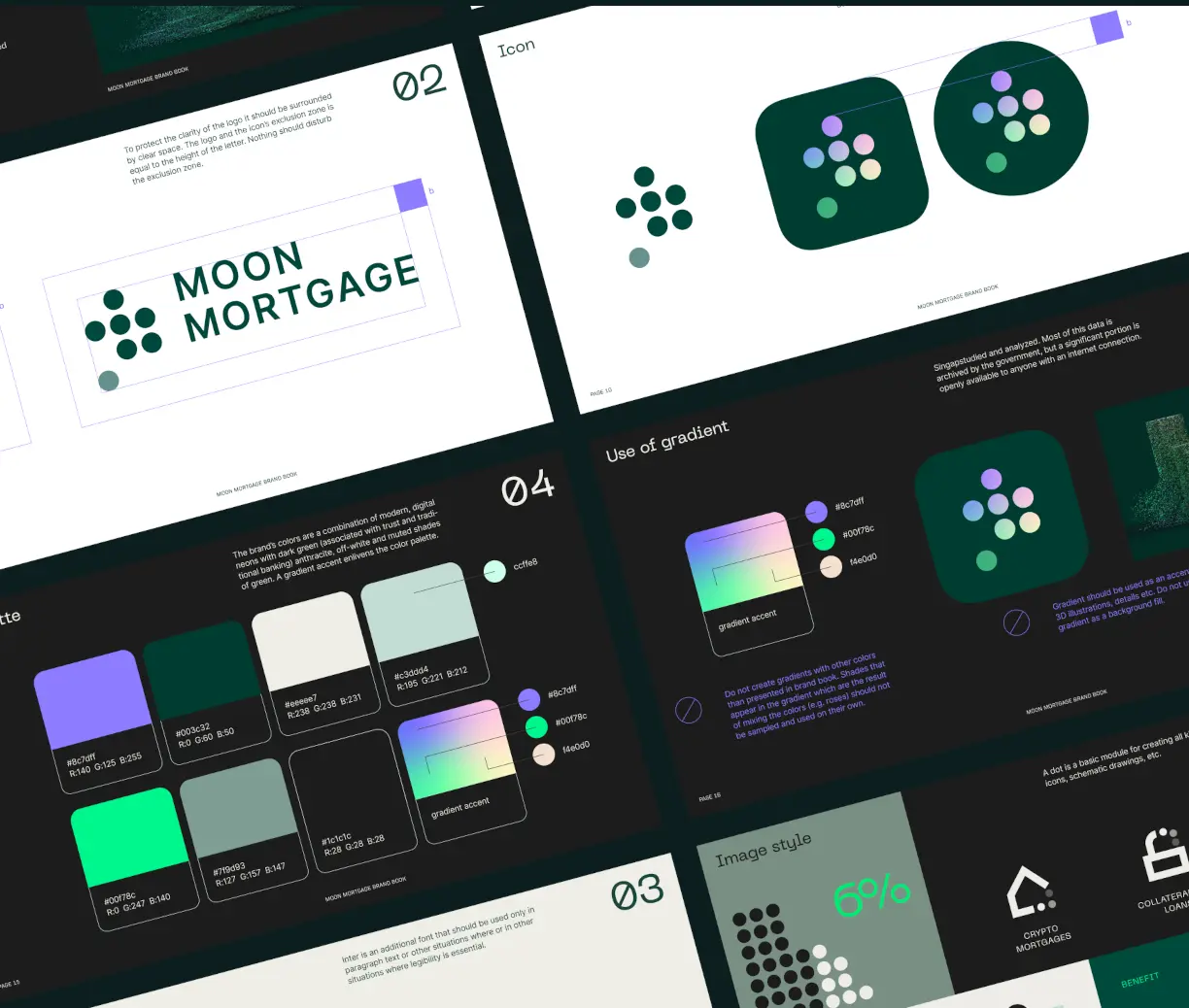

Brandbook

Website

Outstanding design in Web3

Result

The Moon Mortgage platform launched, enabling users to leverage crypto as collateral for US property purchases, bypassing traditional credit. Integrating core lending systems, KYC/KYB, ledgering, and custody, the platform ensured secure, real-time transactions. The cohesive brand identity, from key visual to a user-friendly, mobile-first Webflow website introduced a new quality to the credit industry.