How to Make Sure your FinTech Product is Market-Ready

25.02.2022 | 10 min read

An exclusive Case Study Based on The Crescent App

Making sure that your product is market-ready is one of the key elements of success, no matter what industry you’re trying to enter. But how do you get that crucial product-market fit? And how do you know when to pivot from your original product idea?

Alongside our Head of Design, Wojciech Tymicki, I had the pleasure of talking to the Crescent Team - Grant Roscoe, CEO and Landon Mattison, Head of Marketing about their experience.

Grant, how would you describe Crescent to someone who has never heard of it before?

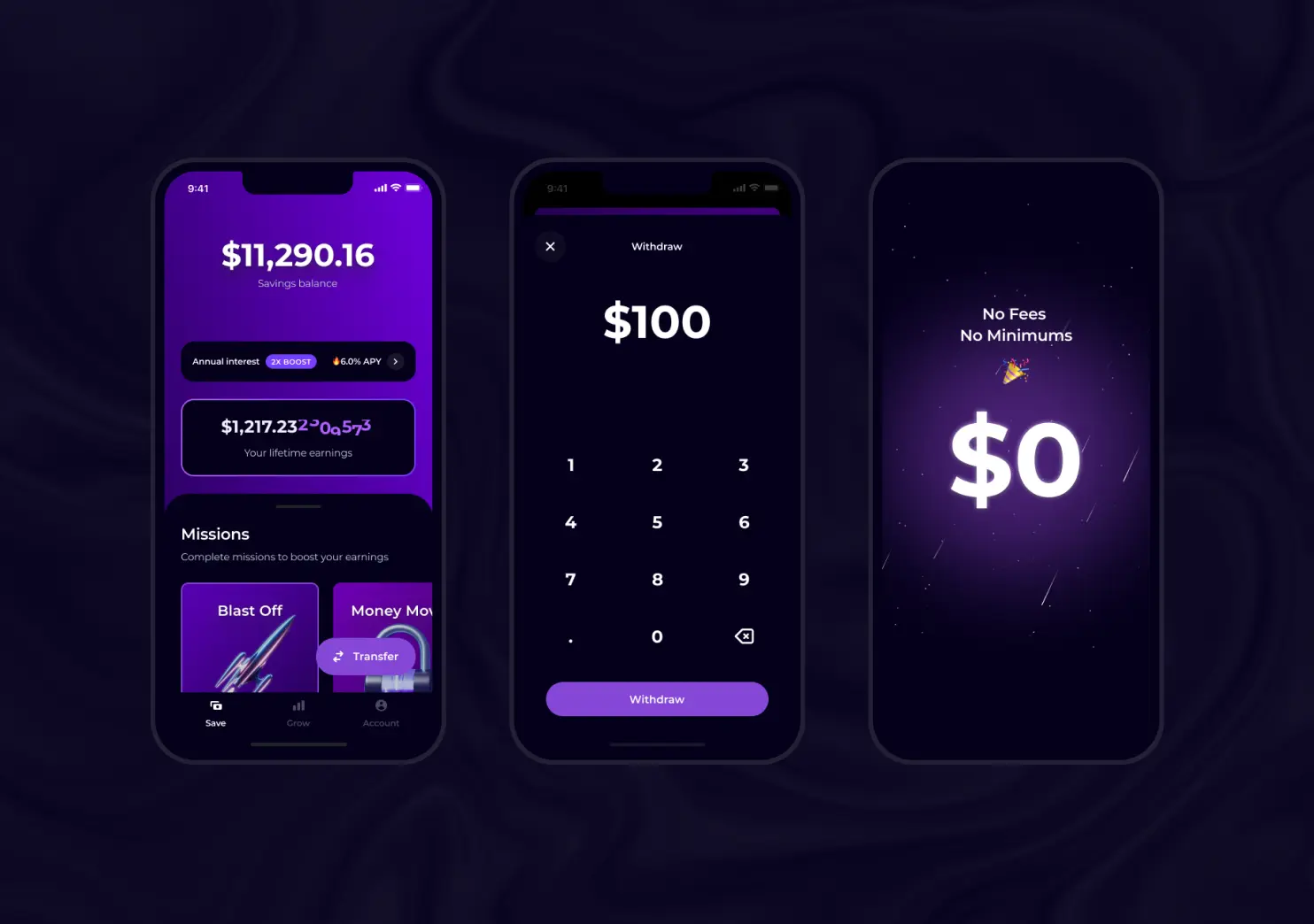

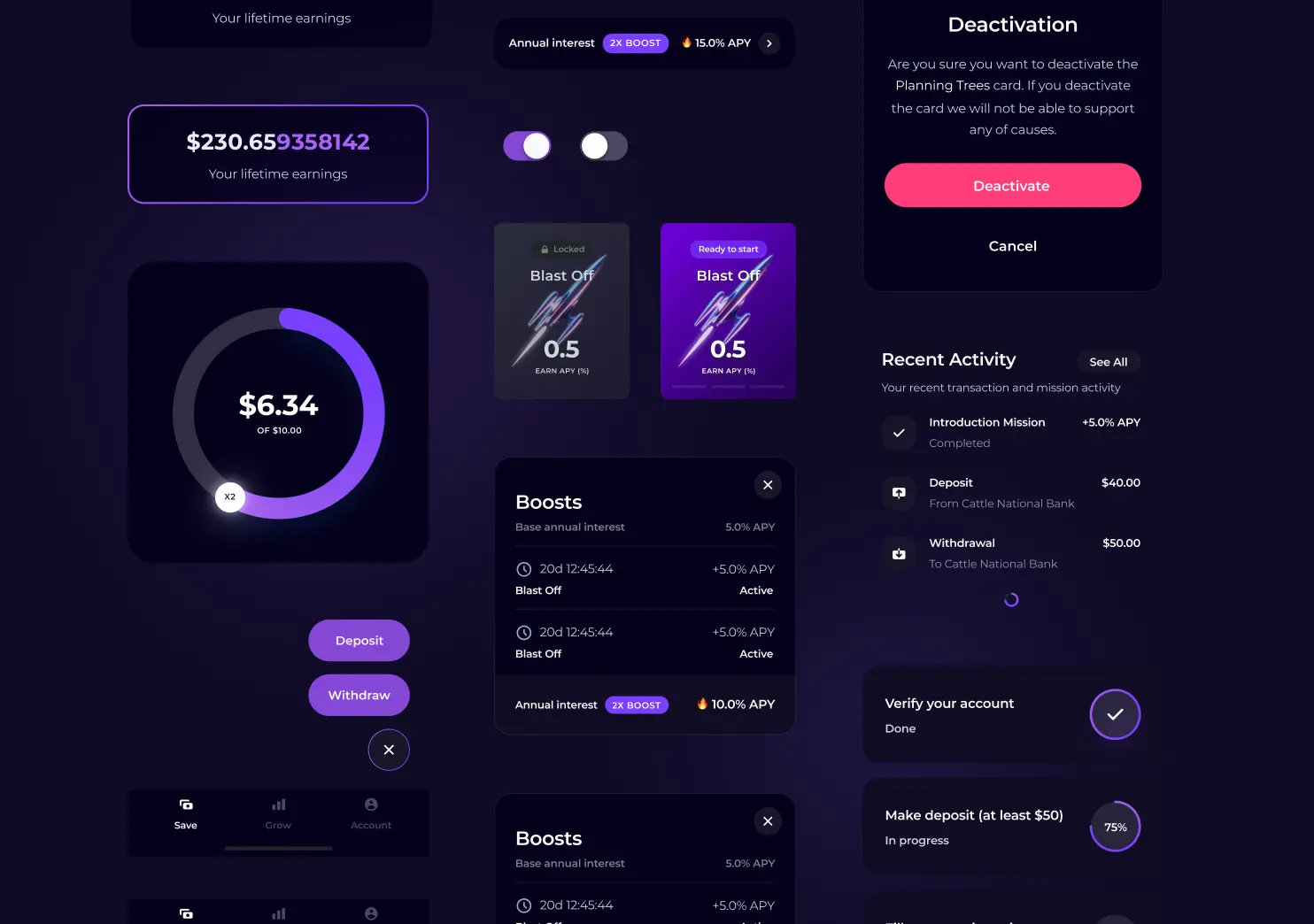

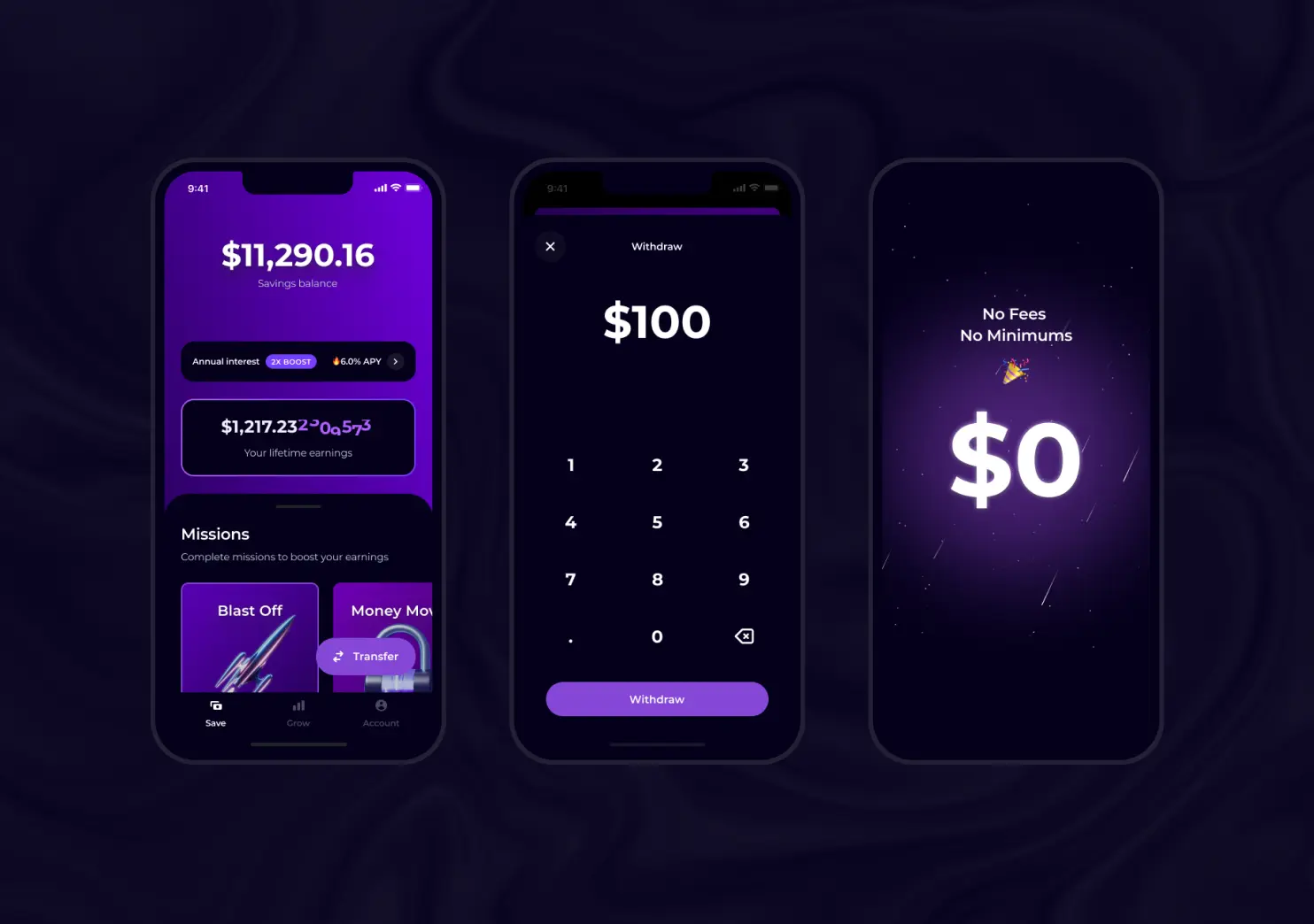

Grant: Crescent today is a little different to what it was when we founded it. Today it is a high-yield savings product that pays you up to 6% interest on your dollars, with interest paid out in real-time every second. We’re also very keen on social impact, where you donate a portion of your earnings towards a cause that you believe in. We have missions in the app where you can earn higher interest rates for bringing along friends or meeting certain milestones, and we do recurring deposits and spare change round-up too. That’s our first product, but there are spend products and invest products coming up in the pipeline.

What is the biggest problem that you’re trying to solve with Crescent and who is the product aimed at?

Landon:

The biggest problem that Crescent solves is giving everyday people access to the best crypto tools.

Right now that’s a high yield savings product. We tried to solve what traditional savings accounts aim to do - which is to offer users a place to put their liquid money and allow it to do more for them than just sitting idly. We’re mainly looking at Gen Z and late millennials who are ‘crypto warm.’ They’re people who are interested in crypto, but just haven’t taken the step yet. We feel that our product is a really good gateway into the best that crypto has to offer.

The persona that was created during our product process was very precise and the advantage of your product over the competition is that it’s really tailor-made for the needs of that generation. Could you say a bit more on that?

Landon: Yes, our whole aim is to make crypto tools really accessible. So we’ve used a lot of the features that users would be familiar with in their traditional savings accounts, such as seeing your balance. And then we’ve added new layers and tools which are more familiar to crypto users. It’s all about walking the balance between the two areas.

Dennis: Thank you for that great description. But as you mentioned yourself, the product wasn’t always what it is today. We started collaborating back in 2017, when your product idea was quite different. Could you tell us a bit about the journey that you went on with Crescent?

Grant: Yes, we started Crescent at the very peak of an ICO boom and there was subsequently a two year crypto-bear market, so raising capital for the company was a very difficult task. Our initial prototype was a product that offered a very simple way to invest in crypto, including bundles and commission-free trading - great tools that we’re still pursuing today. The learning was that it’s very difficult as a first time founder to raise the funding and build a product that can serve the market.

But we’re fortunately in a much better position now and we’ve conducted a product pivot, in terms of leading with Crescent Save, which takes away all the jargon of investing in this new asset class, which is also a bit more difficult to sell.

Crescent Save actually existed in the old version. It was one of the features. But we wanted to launch with Invest. Later, this evolved into being investing and saving simultaneously and we simply stripped back the investing. Because here in the US there's a lot of regulation around what we’re doing and so we’re pursuing Money Transmission Licenses state by state at the moment. They’re difficult and expensive to obtain, but they allow us to offer many services now and in the future. We always planned to do a ‘Save’ type of product; we simply positioned it as the first product that we’re rolling out.

Landon: When we started focusing on Crescent Save as the primary option, it really allowed us to refine our focus on what a great savings experience should look like, and in the process add a handful of features such as the Social Impact Feature that was mentioned previously.

When we started working together, I remember that there was this crucial moment in which we had to decide on the scope of the MVP and narrow it down. Could you tell us a bit about how you did this?

Grant: I think the most crucial part was that we focused on just one product: ‘Save’, rather than ‘Invest’ and ‘Save’ together, and this enabled us to add these ‘X Factor’ features such as the Missions and the Social Impact.

Landon: Yes, making a decision on what an MVP should contain is always tricky. You still want it to have enough features to make it a success in the market and yet not putting so much into the initial spec build that we’re going to over-deliver on something that we haven’t actually tested yet. It’s all about figuring out what’s going to be the minimum viable version that’s going to be a great experience.

How did you use your community as a sounding board to make sure that you were making the right decisions?

Grant: Yes, we conducted around 100+ consumer interviews (each about an hour long conversation) all enabled us to collect the insights that we needed to make this product.

Landon: Coming up with some learning goals was our first priority. We had some good market information based on the initial market research that we conducted. But those initial conversations with prospective customers were crucial. While conducting these interviews, you need to realize that this is the beginning of the research. It’s not the end point. Likewise, we spoke to some very experience UX designers at 10Clouds who told us why certain ideas that we had for our product just wouldn’t work. So we also had to learn from those. It’s a very iterative process.

What do you think is the right moment to refresh your design when you’re repositioning your product?

Grant: I think for us, it was definitely when we decided to focus on our ‘Save’ product rather than ‘Invest’. Invest was a more detailed interface. ‘Save’ was, to begin with, just an interface with a balance being displayed. There was no Social Impact or Missions. We didn’t build out a full app around this particular product, which is why we had to add these ‘X factor’ elements and go through the wireframing process again. This then led to a rebrand of the company, logo and general visual assets.

Wojtek: You did all the research that was needed for a perfect branding brief. We were so impressed with the level of concrete information that we had to work with. And I particularly remember how ‘trust’ was so integral to your brand - and this of course stems from really understanding your target audience.

Your launch is coming up soon. What are your plans following that launch?

Landon:

One of the good things about launching in the way that we’re doing is that we have a chance to get that initial feedback from users before the product goes out into the world.

We’ve had the app in a place where users could be on it for several months now and each week we’re trying to build an analysis of whether this is working in the way that we want it to. If not, than we think about the types of adjustments that need to be made. When we officially launch, it’ll be an iteration, rather than a version one.

Dennis: What tips do you have for a product owner who has an initial concept which they want to move forward with, but the market might be against them?

Grant: I’ll speak specifically to financial tech companies. FinTech is a very capital intensive industry. There are a lot of licenses that you have to build upon and partnerships that you have to make. When you’re starting up, you need resources, which is about having a vision and a unique angle for a product in the market which you can then pitch to investors. That then gives you the funding needed to bring in more team members and to start bringing your product to life. We literally had an idea that we brought to investors. There was nothing substantive behind it.

What’s great about Crescent is that anyone can use it. How did you work together with Wojtek and the design team on this accessibility element?

Landon: One of the things that struck us early on is that we needed to get a good idea of the elements which we knew were going to add trust to the product. We started off by making sure that we’re recognizable to users, and that the features that we’re offering are similar to what they would see in a traditional bank - particularly when it comes to the usual bank balance. One benefit of us being based in Nebraska which is not an area that is known for crypto familiarity, is that you have a lot of opportunity to learn what’s likely to work for the average user.

Then we thought about how we can make earnings an experience, rather than just something that you see as a line item on a statement.

Are you considering potentially launching in Europe in the future?

Grant: It’s interesting, because crypto is more of a gray area than traditional financial markets. So could we do it? Absolutely. I was fortunate enough to spend some time in Europe and to have some interactions with European crypto exchanges and banks which we definitely could have built up relationships with. We started with the US because it’s more of a familiar market for us. We want to own one particular market and then expand from there.

So what is the roadmap looking like?

Grant: On the product side, we’re still in the exploration phase. Right now we’re a yield providing platform but there are several things we can do. We can plug users in, in a seamless way to DeFi protocols for even higher interest rates, beyond just 6%. We can take the position of being like a replacement to a bank account, which includes spending capabilities with a debit or credit card, replacing both your checking and savings accounts through Crescent. That would position us as a true neo-bank type of service.

We’re still planning to launch ‘Invest’ later this year which will involve crypto bundles and commission-free trading, building out education around what these assets that you’re investing in are. We’re deliberately leaving the roadmap quite open and we’re looking to base our decision-making on customer feedback. We’ve got the funding we need for a product-launch on a nationwide scale and build out the additional features that we’ve mentioned.

Thank you very much Grant and Landon.