Coinbase, one of the largest crypto exchanges in the US, is going public today. Following the likes of Slack and Spotify, it has opted for a direct listing of its stock, rather than using a bank as an IPO broker.

What does this mean for existing investors? The existing investors, promoters and even employees holding shares of the company can directly sell their shares to the public.

Big news for Bitcoin’s future

The IPO is important for Bitcoin’s future, giving it an even greater share of public attention and increasing its value.

As Forbes has reported:

One Bitcoin was valued at around $1,000 at the beginning of 2017, and as of Feb. 26, that same Bitcoin is now worth more than $47,000. When Coinbase first announced its intentions to go public in late 2020, Bitcoin was worth almost half that amount.

About Coinbase

Coinbase describes itself as “a secure platform that makes it easy to buy, sell, and store cryptocurrency, with over 89 million verified users, like Bitcoin, Ethereum, and more.”

One of the biggest selling points of Coinbase, so to speak is that it serves a wide client base and that it offers different things to different people.

For those beginning their Bitcoin journey

It operates as a simple online exchange for Bitcoin enthusiasts, and at its core, it offers a platform for retail buyers and sellers to agree on a price that would suit both parties.

For Bitcoin pros

For more experienced users, Coinbase has a robust trading platform called Coinbase Pro. This features all the data, charts and detail that you need in order to successfully penetrate the depths of the crypto market. There is also a free wallet service enabling users to safely store their cryptocurrencies.

Data security

Coinbase places a huge value on client security and has thus far managed to successfully keep users’ personal data secure. Many other competitors have failed in this regard, including the sad story of Mt. Gox.

Usage is increasing

In a mid 2020 report, the company stated that it had 35 million users, including both retail clients and institutional firms. This is an increase of 5 million since the previous year, and numbers are consistently rising.

Why 10Clouds is excited about the IPO

At 10Clouds, we are growing our blockchain offering, and the IPO gives us continued trust in the future of the sector.

A slick UX and UI experience

Coinbase is the first large exchange that was very accessible to the larger B2C market. This is mostly due to its user friendliness, straightforward UX and slick UI - all of which are areas which we pride ourselves on.

We have more than 25 blockchain projects under our belt creating or enhancing exchanges, wallets, onboarding processes and dApps with strong and user friendly design and development.

Take a look at some of our projects.

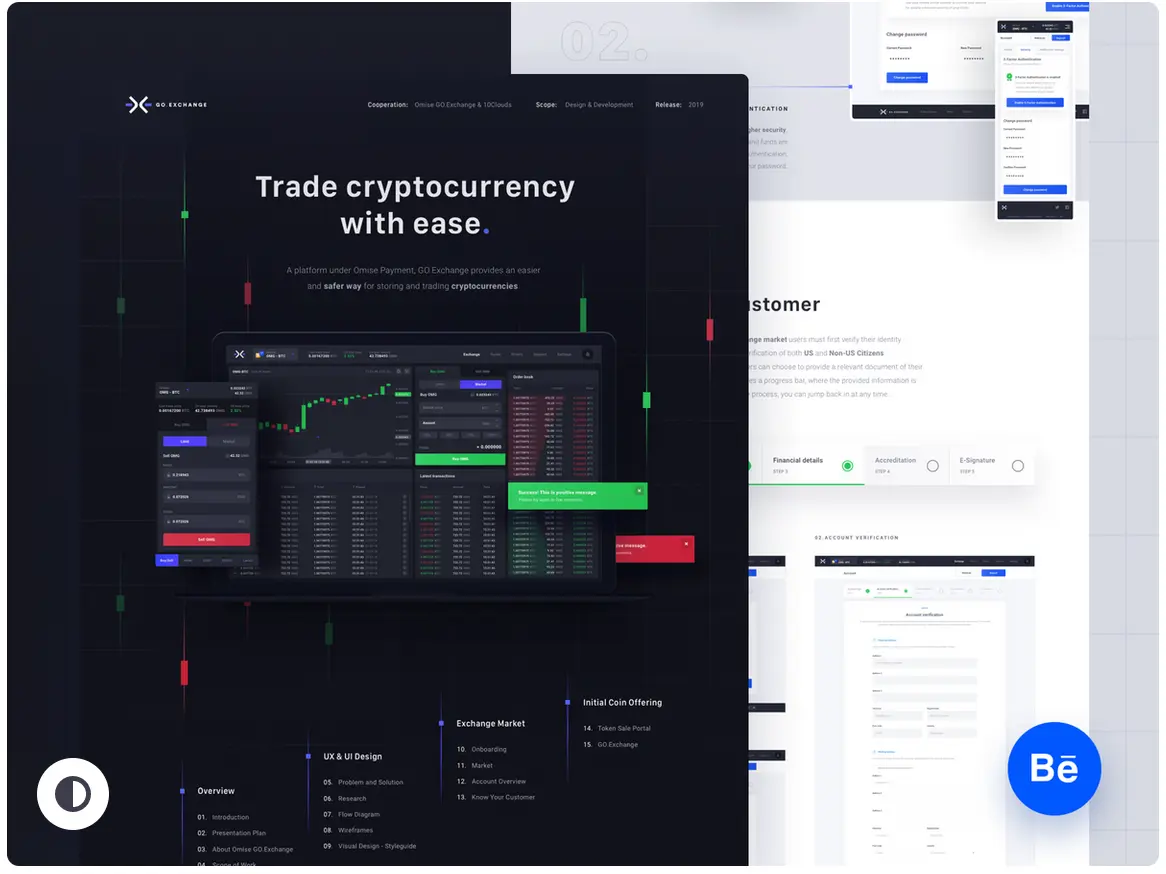

GO.Exchange (Omise)

Go.exchange is a platform under Omise Payment - a leader payment gateways in Asia, who owns the cryptocurrency Omise.GO. At the time when we started our co-operation Omise.GO was ranked at #16 place at Coinmarketcap in terms of market cap over $750,500,000.00. Our goal was to create a brand new digital asset exchange on the market, with a reliable brand behind it.

See our case study on Dribbble here.

Coinquista

10Clouds has developed a complex cryptocurrency exchange platform. Coinquista allows users to invest in cryptocurrencies, store their funds securely, and track market trends.

We created multisignature, cold wallet, two-step verification, and other reliable standards to provide the highest level of security.

See our case study on Behance here.

Are you looking for expert advice about blockchain implementation at your company?

Get in touch with me for a free blockchain consultation. You can contact me on dennis.vandervecht@10clouds.com or call me on +48 793 200 141.