The worst thing about loans is that you have to repay them with your own money. But what about getting a loan that repays itself? While it may sound like a miracle, self-repaying loans have now become a reality thanks to the newly launched platform Alchemix.

The platform creators claim in their videos that they rely on some magic powers to make debts disappear without any effort from the end-user’s side. But in fact, they simply make use of the latest innovations based on blockchain technologies. How is this possible and can such an approach become the future of hybrid DeFi apps? Let’s take a closer look.

» We are 10Clouds: Introducing the DeFi Developer Roadmap

What is Alchemix?

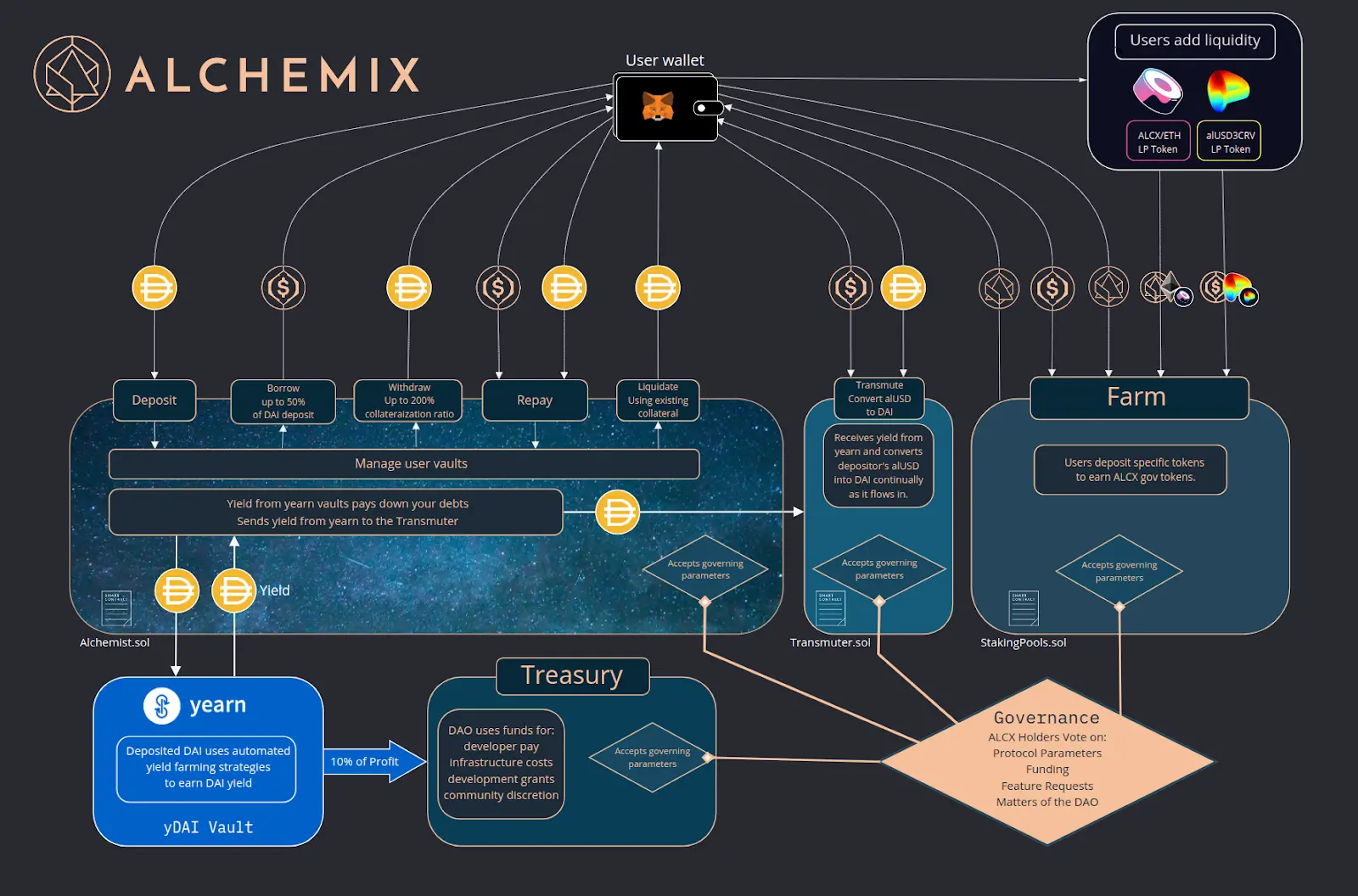

Powered by the Ethereum blockchain, Alchemix represents a new DeFi lending protocol that offers a new way of repaying debts. To get an instant loan on Alchemix, users must deposit collateral that will serve as a guarantee that the funds will be returned. In return, they get a stable coin with high liquidity that they can use for their own purposes.

In short, the process looks as follows:

- Make a deposit in DAI (collateral) into the Alchemix ecosystem

- Up to 50% of the deposited sum is available as a loan that users get in the form of a synthetic token alUSD created by the platform specifically for these needs.

- In the meantime, your deposit earns yield that over time repays your debt.

How is the last aspect possible? The answer is simple: the deposited funds are placed in another platform Yearn Finance to earn yield which makes up around 12% APY. This yield becomes the source of paying off the debt.

How does Alchemix work?

Passive functionalities in DeFi have amassed devoted aficionados. Take Balancer - a market-making protocol for passive income. And what's the Alchemix's angle here? To make self-repaying debts a reality, the Alchemix team implements a variety of additional features aiming to serve borrowers:

Vaults. On the Alchemix platform, users manage their yield advance positions through vaults where they store their deposits in DAI. This feature is similar to other blockchain-based platforms such as MakerDAO and AAVE.

Transmuter. This mechanism helps Alchemix maintain a stable ratio of alUSD and keep it pegged to the DAI value. With the help of Transmuter, users can convert alUSD into DAI and then easily cash it out on any exchange that supports this coin.

Strong pegging mechanism. As users repay their debts in alUSD or DAI, they can get additional profits when the 1:1 ratio deviates. If alUSD value gets below DAI, users can buy it on the open market and pay off their debt with a discount. Alternatively, they can mint and sell alUSD to arbitrage the price down and repay debts with DAI.

Diversification to protect against market calamities. To protect borrowers against market collapses. Alchemix team plans to launch a multi-asset alUSD by adding other stable coins to the basket. New stablecoins will be chosen by the community through voting.

Liquidity pools. Those who want to make a profit as liquidity providers can stake their funds in the liquidity pools of the platform and earn ALCX tokens for that.

What benefits do users get?

The mechanisms underlying Alchemix give their users a number of benefits:

Instant loans in crypto. If you need money urgently and you have no time to get a loan from a bank, you can rely on this platform to get instant loans with no identity check and credit history.

Loans get paid back automatically. There is no deadline to pay off your debt. If you can’t find sufficient funds, you may simply leave your deposit in the vault, and the needed sum will be generated without any active efforts on your behalf.

Earn future yield. You can make passive income by providing the network with your own resources.

Thus, with Alchemix borrowers can get the required funding and sleep soundly even if they cannot repay it.

Risks to consider

Although the picture looks really bright, there are also some drawbacks that both lenders and borrowers must keep in mind before they decide to use Alchemix services:

Cash is not supported. The only available payment options are in crypto.

Not fully audited. The service has the audit plans specified in its roadmap, but as of now, there may be some unexpected bugs that may be exploited by hackers and result in money losses.

Not fully decentralized. Neither does the team claim it to be this way.

Not the highest yield available in the market. There are other similar offers that offer much higher APY for staking, starting from Yearn Finance itself.

All these negative aspects may serve as a stop factor and hold back a vast number of savvy users.

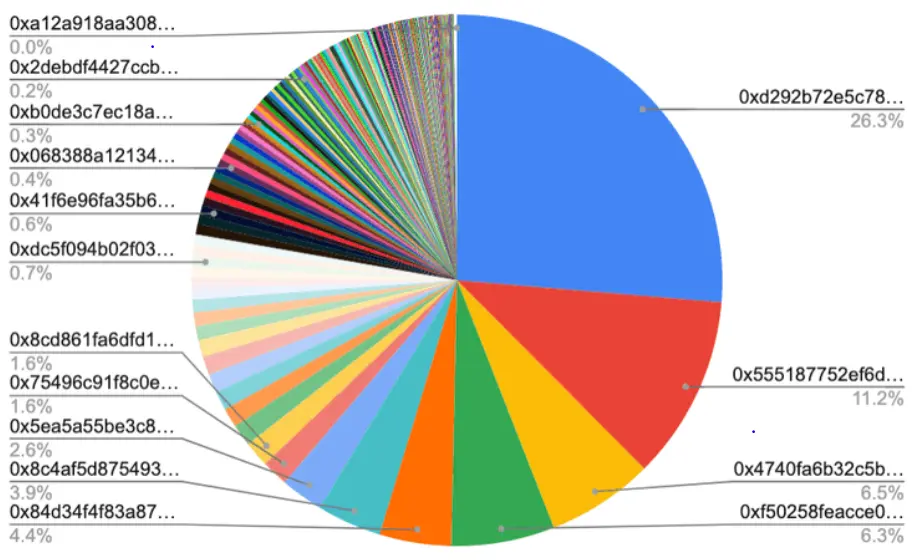

Alchemix is far from being decentralized: there are only 4 major holders to control more than 50% of all funds.

The bright future of DeFi apps

Though DeFi solutions such as Alchemix represent a relatively new trend in the blockchain industry, they have already established themselves as a reliable alternative to traditional lending services provided by banks and other centralized financial institutions.

The boost that DeFi platforms have experienced in the past year shows that there is high demand for such platforms. With the growth of interest, more investments flow into the industry helping blockchain startups develop their ideas further.

Finally, the introduction of Uniswap now allows exchanging ERC20 tokens directly between each other and made the whole process much simpler which has a positive impact on the adoption of crypto.

The high risk of DeFi apps

Despite all the benefits that decentralized financial tools offer, there is still an open question of their security.

Any bug in the smart contracts may result in huge losses both for DeFi platforms and for their users. Moreover, the immutability of blockchain makes it impossible to reverse the smart contract implementation and fix those bugs.

Thorough audits conducted by third-party services can save the situation by helping blockchain companies reveal potential security breaches before the solution is released on-chain. However, the costs of such services are far from being affordable, therefore, many DeFi solutions remain in the high-risk zone.