The idea of decentralized exchanges has been appealing to many, ever since the dawn of the new technology. But it’s only in the last couple of years that some viable tools have started to emerge.

Balancer is exactly one of such solutions. Launched in March 2020, it has managed to quickly grow its user base and now has pride of place among other popular DEXes such as Uniswap, Curve, and Aave. In this article, we are going to review the key technologies that have contributed to its success along with the pros and cons of this project.

» We are 10Clouds: Introducing the DeFi Developer Roadmap

What is Balancer?

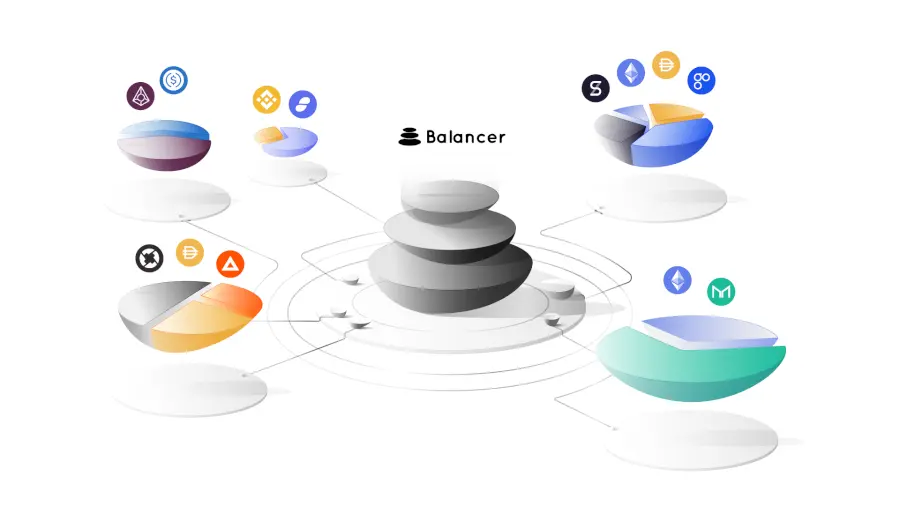

Balancer represents an Ethereum-based exchange for automated market making (AMM). What makes it different from traditional exchange platforms is that it completely gives up accounts and order books and relies on liquidity pools and DEX instead.

Similar to Uniswap and other popular DEXes, Balancer allows its users to contribute funds to the pools and make money on the network commissions. However, there is a core feature that makes it stand out from its competitors.

The unique approach that it utilizes implies automated price balancing. In a nutshell, its algorithms endlessly buy and sell tokens to adjust their prices to the current market state.

Balancer connects various assets in different pools and adjusts their prices to those that are currently available on the market.

The idea of balancing your portfolio to reduce risks is not new. It was first applied in the early ’70s in the form of index funds that enabled portfolio managers to buy or sell assets when their price deviated from the market so as to keep their share stable.

Balancer was the first project to successfully implement these ideas on the blockchain. However, in its case, it’s not portfolio managers but traders who are responsible for balancing assets. They spot arbitrage opportunities and pay network fees for their execution which in turn are forwarded to liquidity providers in the form of rewards.

Pros and cons of Balancer

If you consider Balancer as a potential source of income as a trader or liquidity provider, you should take a look at both the positive and negative aspects of this platform before you make a choice.

The benefits of Balancer include the following:

- Up to 8 different assets are available in a single pool.

- The platform is completely decentralized with no custodial risks.

- The Protocol Vault reduces the number of transactions between different pools and therefore, reduces transactional costs.

- Balancer supports Gnosis protocol. The combination of the two platforms promises higher on-chain liquidity, MEV protection, and optimized trading fees to its users.

There are several downsides as well:

- Liquidity providers face the risk of impermanent loss - a temporary loss of funds occurring when providing liquidity. It is often described as the difference between holding an asset versus providing liquidity in that asset. But note that this issue is not unique to Balancer - it is the same in every DEX.

- The platform has experienced successful hacking attempts. In June 2020, a hacker exploited a vulnerability found in the code and conducted a flash loan attack resulting in a loss of nearly $500k worth of crypto. But note that the Balancer team has reacted by providing bounty programs to discover and secure potential system vulnerabilities.

- Additionally, there is no mobile version of the platform which may be considered as a con by those who prefer trading on the go. However, as the team still hasn’t made any advances in this direction, it’s relevant to assume that the number of mobile users is not that big yet.

Additionally, there is no mobile version of the platform which may be considered as a con by those who prefer trading on the go. However, as the team still hasn’t made any advances in this direction, it’s relevant to assume that the number of mobile users is not that big yet.

Speaking about vulnerabilities, the Balancer team doesn’t sit idle, though. On the platform, there is an ever-going bounty program with substantial rewards to those who manage to discover any more bugs in the code of the exchange.

Balancer vs Uniswap

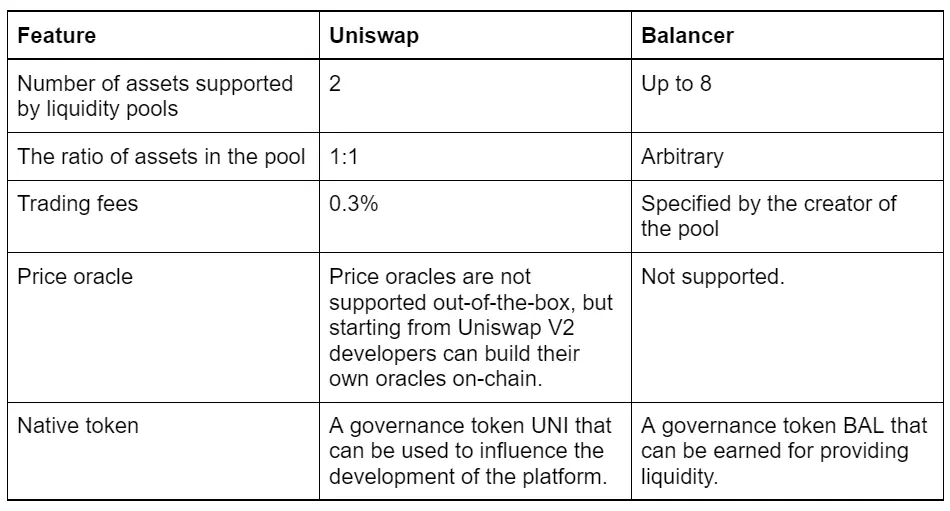

As previously mentioned, Uniswap and Balancer are two of the leading DEXes. But it’s important to note that the Uniswap protocol offers a distinctive, decentralized governance model, while the Balancer protocol allows its user to decide on custom trading fees and provide liquidity for up to eight assets in one liquidity pool.

The list of key differences between these two platforms is presented in the table below:

Getting started with Balancer

If you want to join Balancer as a trader, all you need is an Ethereum-compatible cryptocurrency wallet. Metamask, TrustWallet, or Atomic wallet can be a good fit. The platform doesn’t require its users to pass any KYC (Know-Your-Customer) procedures, so you don’t need to worry about the security of your personal data.

- Open the ‘Trade’ tab in the Balancer app.

- Connect your wallet.

- Select the pair of coins you want to swap (i.e. exchange) and finalize the transaction.

- If you want to make passive income by providing liquidity, the procedure is just as simple:

- Go to the Balancer Pools.

- Connect your wallet.

- Select one of the pools from the list and finalize the transaction.

Note that if you want to join some pools but you don’t have the required coins at hand, you can always get them via swapping on the trading tab.

Balancer — a world of potential

Balancer is certainly gaining in popularity, but it has a way to go in comparison to its rival Uniswap in terms of activity. Nevertheless, its team already has a bright future planned. Balancer's development will be focused on two major events — the 'Silver Release' and 'Golden Release.’ The Silver Release will include several gas optimizations and the Golden Release will focus on the release of new features, including a brand new liquidity mechanism.

In summary, Balancer is a DeFi powerhouse which is not without its risks, but it’s definitely worth trialling.