NFTs have been riding on a tidal wave of popularity for a number of months now. They are "one-of-a-kind" assets in the digital world, and can be bought and sold like any other piece of property. The only difference is that they have no tangible form of their own. But more and more users are fractionalizing their NFTs. Why? It mainly comes down to cost. Popular NFTs like CryptoPunks can cost hundreds of thousands of dollars, which makes them unaffordable for the average punter. But what if you could own just a fraction of these NFTs? Well, now you can.

What Are NFTs and How can you Make Money on Them?

Before we fractionalize our explanation further, it’s important to first understand how NFTs operate in general, their use cases, and means of monetization.

While fungible crypto assets such as Bitcoin or Litecoin are equal to each other, and their mutual replacement doesn’t change anything, each non-fungible token is unique, and therefore irreplaceable. This is what makes NFTs a perfect tool for registering and tracking unique objects on the blockchain.

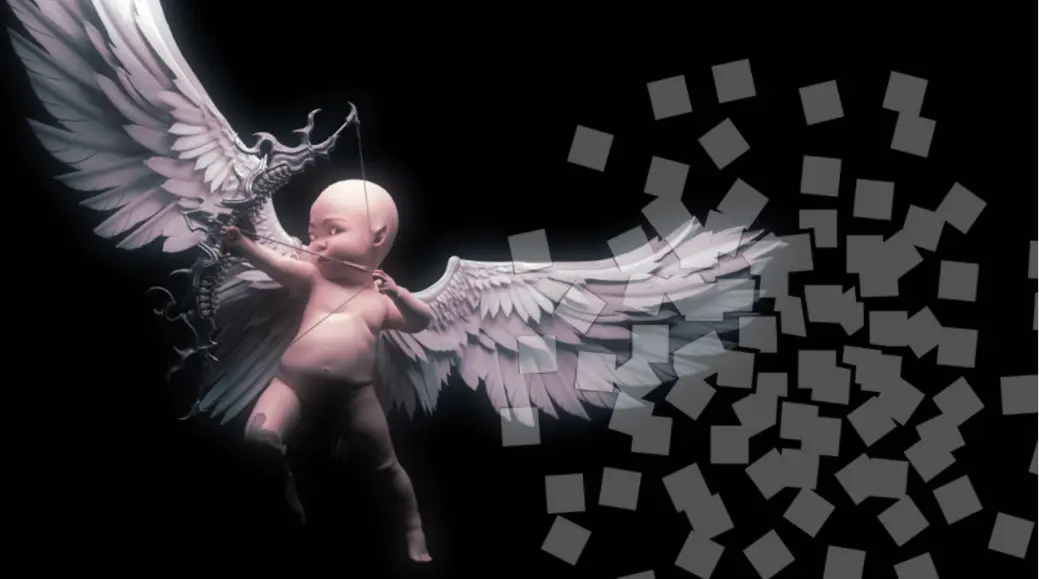

To earn money via NFTs one can resell or create new unique projects. This is exactly what many world-renowned people do. Singers, artists, DJs, and even major publishing companies proceed precisely in this way. Thus, the mother of Elon Musk’s child, singer Grimes, sold her 4 drawings of an angel-winged baby, having divided them into 400 NFTs. Grimes gained $5.8 million for the artwork within just 20 minutes of the sale.

Grimes’ NFT art called “Newborn 1 & 3” which can be purchased in shares at $10 per share, which could be purchased at $10 per share.

What Are Fractional Non-Fungible Tokens (F-NFTs)?

The idea of NFT fractionalization is to provide the possibility for several co-owners to possess a tokenized object. The owner of this object can issue a number of tokens that are the parts of the initial NFT and distribute them among the interested parties accordingly. Thanks to fractional NFTs, expensive and unique objects can belong to several people at once.

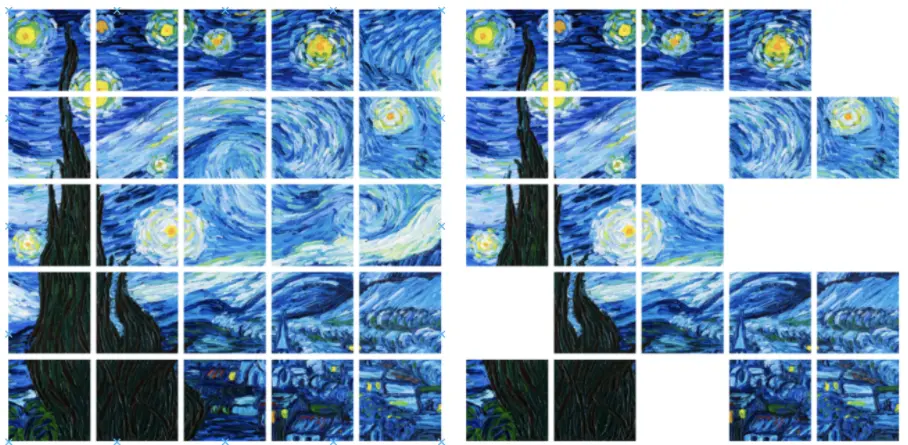

If you are the owner of van Gogh’s Starry Night and you want to sell your collectible, you may find it hard to find a buyer due to the high cost of the painting. However, smaller fragments are much more affordable as they allow purchasing items for much smaller sums and thus conduct various transactions much easier.

This is what the division of tokens may look like. Each part of the painting belongs to different owners which makes it easier to buy or sell it.

» Read more: Developing your NFT marketplace - why discovery phase is key?

The pros of F-NFTs

The introduction of F-NFTs has made the technology even more popular as an increasing number of people have started to invest in the new industry. The advantages of the new approach are numerous.

Quick estimation of value

F-NFTs can help one to quickly estimate the market value of unique tokens. Thus, if you own digital artwork and need to know its price, all that you need to do is to divide the associated NFT into several parts and sell some small fractions on the market. This will help you estimate the overall price of the object.

High liquidity

Fractional NFTs can easily overcome liquidity issues inherent to costly NFTs. If you own a very expensive product and decide to sell it, you may have to wait quite a long time before you will be able to do this since not every investor will have a sufficient sum at hand. Having divided it into smaller fractions, you can split the ERC-721 token into several ERC-20 tokens and sell them for a lower price. This can make the object more attractive to investors and resolve the liquidity issue.

What the division of tokens might look like.

Democratizing investments and easy monetization

Fractionalized tokens may attract investors with limited funds and provide them with more opportunities enabling them to safely acquire valuable assets - provided that they make the purchase on a secure marketplace.

Curator rewards

The party engaged in the token sale can receive an additional amount each year, i.e. curator rewards. This opens up new opportunities for money-making and facilitates the lives of artists who may not be that skilled in the blockchain.

DeFi integration

Fractional NFTs are essentially ERC20 tokens (a standard used for creating and issuing smart contracts on the Ethereum blockchain), which means that staking, yield farming and dexes are all available for integration.

The Risks Associated with F-NFTs

Just like everything else in this world, F-NFTs have their downsides as well. Those who want to invest in this new type of asset should consider the following risks.

The reconstitution problem

When it comes to owning just a fraction of an NFT, reconstitution can pose an issue. If you own an entire NFT, things are simple. You own it in full, and you can sell it as and when you please. However, if you own 50% of an asset, this may not allow you to use even part of that asset in a given name. If you sell 50% of that asset to a buyer and they later refuse to sell it back to you, you’ll find yourself in trouble. So what can be done? Fractionalization protocols have to offer a way to reconstitute fractions into the original NFT.

Buyout auctions

Buyout auctions are a way of solving the reconstitution problem. Let’s take an example:

Person 1 sells 50% of their NFT to Person 2 using a fractionalization protocol with a buyout auction mechanism. Person 3 could trigger a buyout auction for the fractionalized NFT at any time. In such an auction, the person that bids the greatest amount (which could be Person 3), receives the entire NFT. When this happens, the proceeds are split 50/50 between Person 1 and Person 2.

So why are buyout auctions ‘a necessary evil’? Well, it means that even if a single shard of a fractionalized NFT is destroyed, it doesn’t mean that the other shards lose all their value. Let’s say an owner loses one of their 100 shards immediately after minting, they can initiate a buyout auction and submit the winning bid to get back the NFT, receiving 99% of the proceeds back.

Undesired buyouts

But it should be noted that undesired buyouts do happen. If an NFT is valuable enough, there’s a chance that nobody is able to raise enough funds to pay a fair price for it at auction.

Let’s go back to our example of an NFT being owned 50-50% by two different owners. Suppose Person 1 purchases the NFT originally at 50ETH, and then sells half of it to Person 2 using a fractionalization protocol with a buyout auction mechanism. However, then market conditions change and the price of the NFT shoots up a hundred-fold to 5,000 ETH.

Due to market constraints, finding a buyer who is willing to purchase the NFT in full is likely to prove difficult or even impossible, meaning that the NFT never achieves it’s full value at auction. Now this may not bother Person 2, who is willing to sell the NFT at simply the highest price that it can fetch, but Person 1 may be opposed to selling at less than the market value. This illustrates how the situation can lead to shard owner disagreements.

Such a situation can also offer an opportunity to some collectors who can win bids for NFTs at less than their market value, due to nobody being able to beat their bid at short notice. They can then list the item at a much higher price a few months down the line.

Recurrently Issued Collectively Kept Shards (RICKS)

RICKS offers another way of solving the reconstitution problem, but it also sidesteps the liquidity and coordination issues of a full buyout. How does it work? Well, in the place of an all-or-nothing buyout auction, the protocol issues new RICKS for a given NFT at a constant rate - i.e. a given percentage every day, week or month. The new RICKS are then sold for ETH at auction, the proceeds then going to existing RICKS owners.

This benefits the buyers who are liquidity constrained but want to increase their ownership, because it means that they can trigger auctions for less than a full day’s quantity of RICKS. An additional benefit is that the ownership of the NFT will go towards simply the person that is willing and able to pay the most for it.

Conclusion

At the first glance, the NFT industry may seem to be fit for leisure activities only as one can play, listen to music, and collect images here. However, it is also a new way of generating income.

Fractional NFTs have emerged as a response to the market requirement to make investing in unique objects more affordable. Their introduction has made the process more affordable by offering greater liquidity and allowing investors with limited funds to buy NFTs. Now some investors can own large and expensive assets, while others possess only their parts. However, it’s worth bearing in mind the limitations and the risks of fractional ownership and fully understanding the different ways in which the problem of reconstitution can be solved.